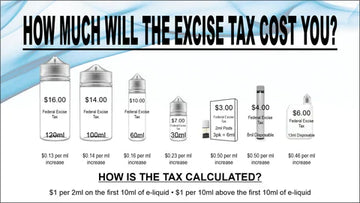

The duty/tax is calculated based on the liquid volume of the vaping substance contained in a single container (in mL). At this time, taxes/duties are charged and collected at the Federal level. Should provinces be allowed to collect their own taxes for e-liquid this increase could effectively double.

For the first 10mL of vaping substance, an excise tax/duty is applied at a rate of $1.00 per 2mL of the vaping substance (liquid).

For each additional 10mL of vaping substance thereafter, a tax/duty is applied at a rate of $1.00 per 10mL of the vaping substance.

Federal Excise Taxes Size Chart

3 x 2mL pods = $3 = $0.50 per mL increase

2 x 2mL pods = $4 = $0.50 per mL increase

8mL disposable = $5 = $0.50 per mL increase

13mL disposable = $5 = $0.46 per mL increase

30mL bottle of eJuice = $7 = $0.23 per mL increase

60mL bottle of eJuice = $10 = $0.16 per mL increase

100mL bottle of eJuice = $14 = $0.14 per mL increase

120mL bottle of eJuice = $16 = $0.13 per mL increase